How is Fintech Modernising Digital Payments in India?

The world is witnessing steady growth, with emerging markets leading the charge, and today, paying is not just a transaction for consumers but an entire experience altogether. Digital Payments have become more convenient for customers, given the development in the FinTech industry. Remember, when we had to rush to the bank for the smallest of the work related to our banking needs? Now, everything has reached our fingertips, and it is a profound example of Fintech modernising digital payments in India. The massive shift towards digitisation has opened a myriad of opportunities around digital financial services.

Impact of Payment Digitisation on Consumer Behaviour?

Propelled by technical and policy innovations, the Digital payment system of India is a promising success story in making. The industry has come a long way, and it is growing exponentially. It still can’t be inferred if digital payments are reshaping consumer behaviour or shifting consumer behaviours is evolving the payment industry. Advances in digitisation, technological innovations, secure payment gateway, QRs, UPIs, and favourable ecosystems are a few significant factors driving significant changes in the payment landscape.

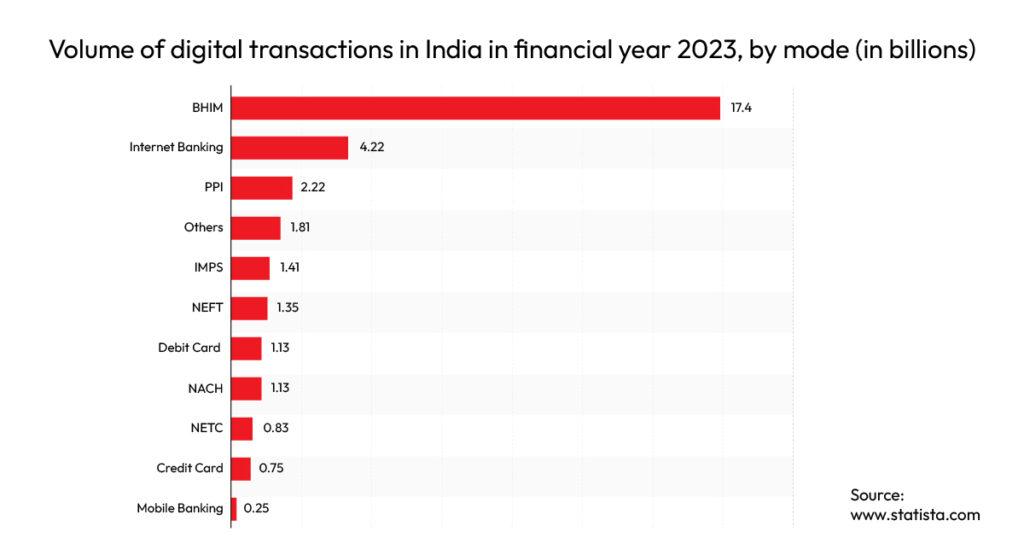

Gradually consumers are gaining confidence in digital transactions, which can be figured out with a whopping total of about 1,050 crore retail digital payment transactions processed in January 2023, as stated by RBI Governor Shaktikanta Das. The gradual acceptance of digitisation has opened the mindset of people in favour of the safety and security that digital fund transfer methods offer. To keep up with shifting and burgeoning consumer demands, financial institutions (FIs) and FinTech thrive to offer the best possible services to meet the needs.

Fintech Bridging Geographical Barriers in India

Indeed, India continues to have the highest underbanked and unbanked population, with relatively scanty internet penetrations and infrastructures supporting digital payments. However, the FinTech sector and its innovations have successfully managed to achieve the farfetched idea of connecting the underbanked section of society to the outgoing urban population. The FinTech sector has created a strong and agile infrastructure by leveraging its benefits, and by adopting reformed services such as contextual banking and Open Application Programming Interface (API). Here is how fintech innovations can help accelerate financial inclusion, and technologies like AI and ML will further bridge the financial divide in India.

- Banking the Underbanked

- Increasing Trust and Convenience

- Providing Access to Basic Credit

- Fulfilling Unmet Credit Needs

- Prevent Frauds

Digital Payments Breaking the ‘Traditional Banking’ Shackles!

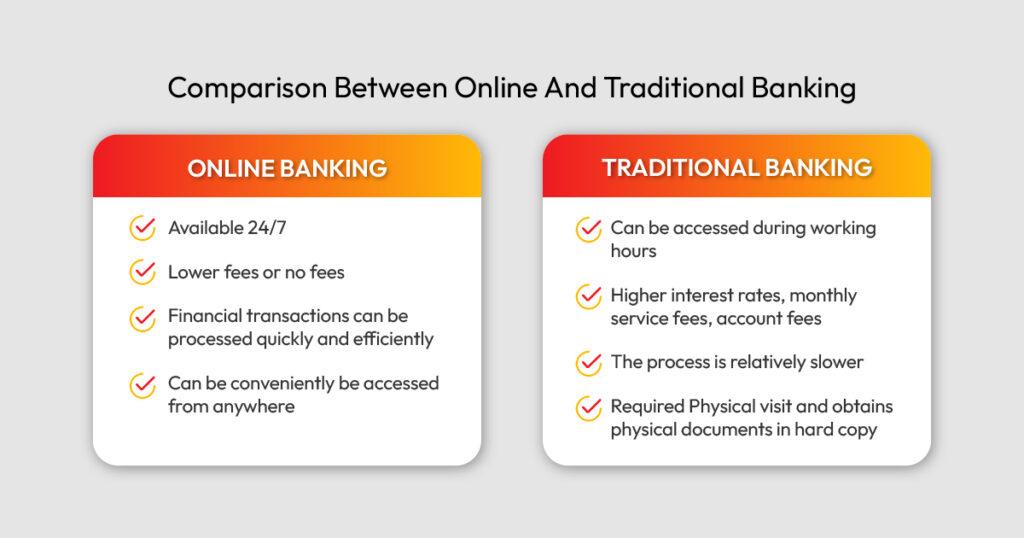

The new generation in rural demographics of India is quicker in adapting to technology and innovation. The shift is contributed by the customer-centric user interface, making it easier to understand and work on the pain points of conventional banking cash transfers. Earlier, a mere bank transfer was a tiring assignment that included the hustle of reaching the bank, collecting the token, waiting in the long queue, and tolerating the tantrums of the person on the other side of the table. Going digital is a crucial step on the path of economic transformation, however, adaptability to consumer needs is the key to sustainable growth.

Although the needs and demands of the consumer will grow perpetually, thus, the entire online payment ecosystem must realign itself based on the requirements. Fintech and financial institutions play a significant role in delivering world-class digital payment solutions, richer experiences, and enhanced innovations, also thriving to bridge the geographical barriers by collaborating with new-age tech partners.

Future of Digital Transaction in India

India’s digital Payment industry is estimated to grow more than triple from $3 trillion to $10 trillion by 2026. The growth arc of the online payment system is impressive, considering the population of the unbanked population. With the customer-centric approach, India’s digital payment industry is making digital payments a seamless experience. Here are a few key factors, that are likely to shape the FinTech industry in the coming years.

- Adoption of New Payment Technologies

- E-commerce Growth Rate

- Integration with Payment Gateway

- Security and Fraud Prevention

- Government Initiatives

Why Do You Need Pay10 as Your Digital Payment Solution?

Payment Gateways provide a systemised payment process facilitating flexible payment methods and contributing to the growth of your business. Pay10 is a 360 degrees trusted Payment Service Provider, offering a robust security infrastructure, and we are certified by top-of-the-line industry standards. Catering to a wide range of industries, we build strong partnerships with the associated businesses and offer a commitment to our people across all geographies.